Regarding HS code and duty rate of face masks in some major countries, we collected some information in main trade partners (US, Japan, EU, Korea, Taiwan, Australia, New Zealand) of China. This is aimed at the face masks such as personal protective masks without special function components, including medical face masks and disposable face masks. All of below information were published by the custom officially.

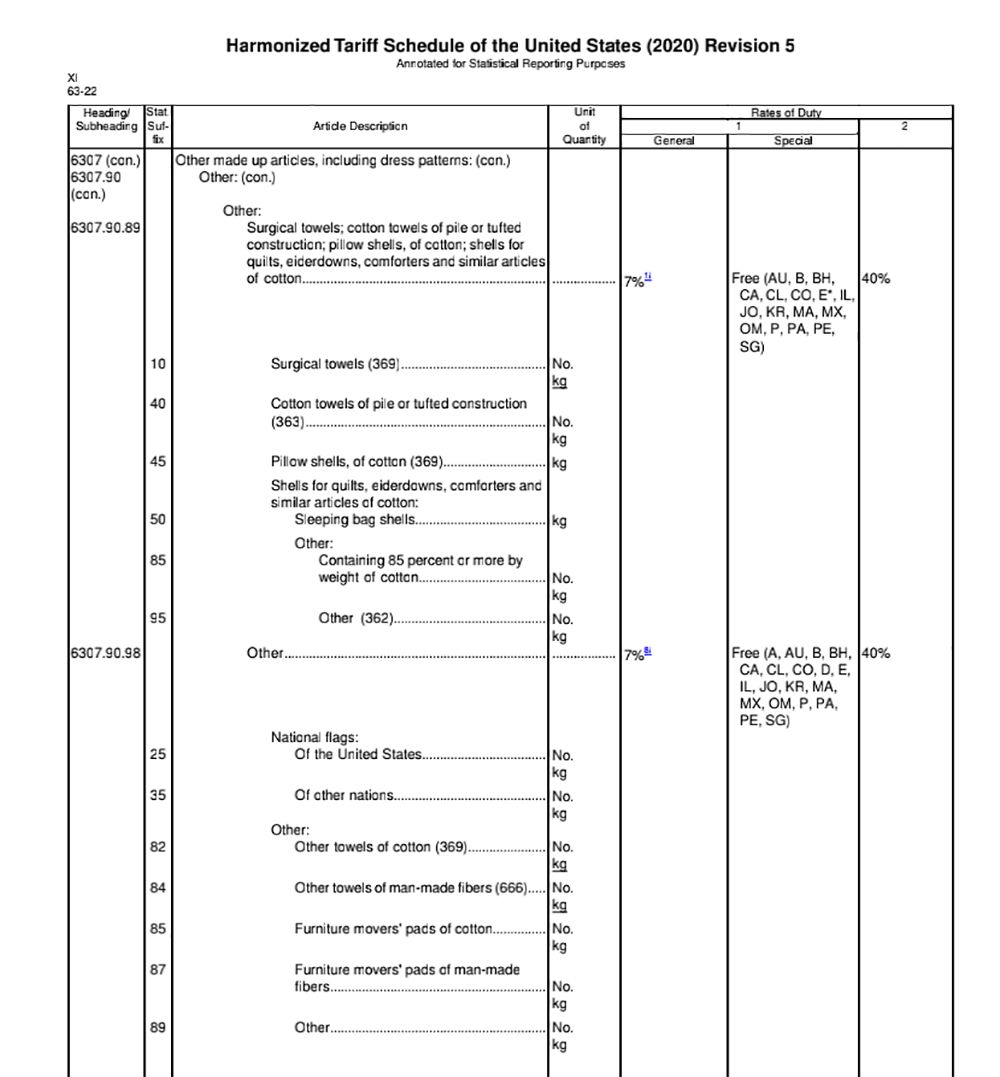

US:

According to Harmonized Tariff Schedule of the United States, HTSUS, the HS code of face masks in the US is 6307909889. And the duty rate imported from China is 7%. Regarding tariff imposed, according to announcement from the United States Trade Representative on March 12, 2020, the tariff is excluded for the face masks belonging to this HS code since September 1, 2019. Since then, all the face masks imported from China has been exempted from tariff. You can refer to the below chart for more information.

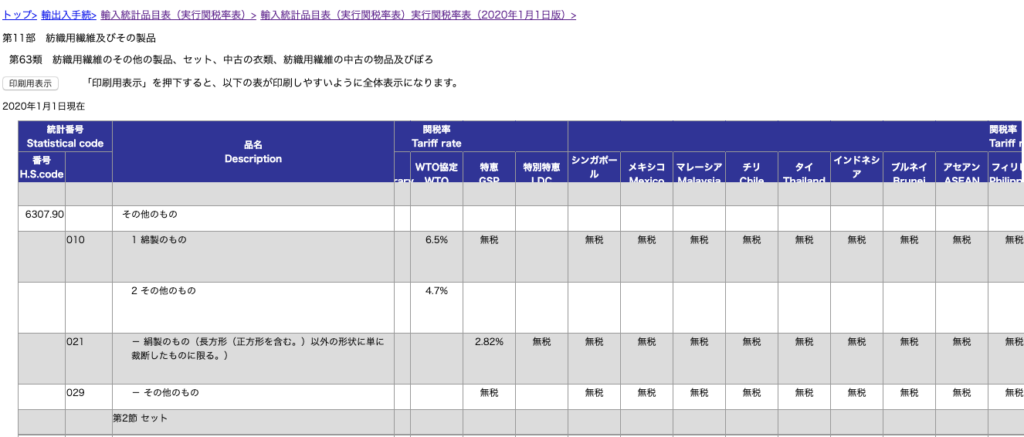

Japan:

The HS code of face masks in Japan is 630790029. The duty rate imported from China is 4.7%. To learn more, see below:

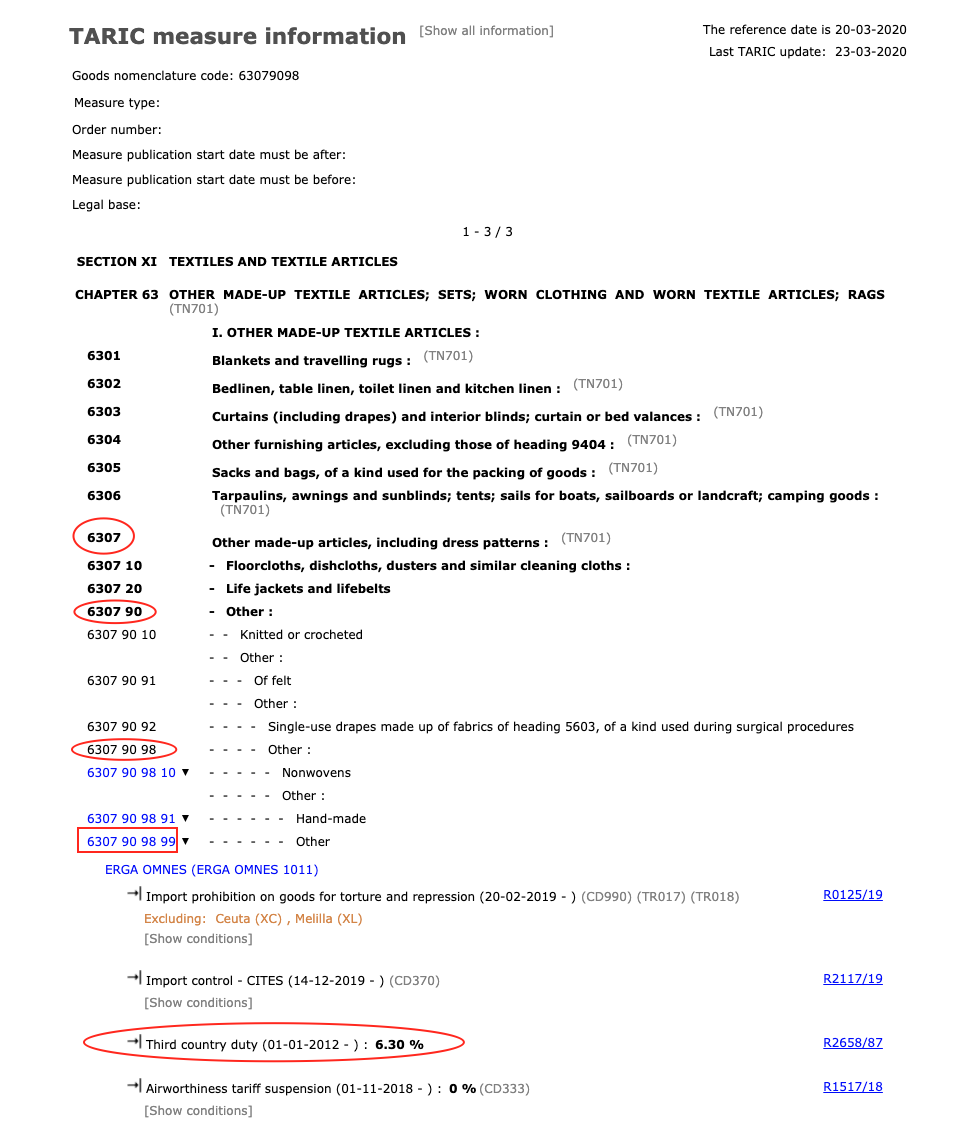

EU:

The duty paragraph for face masks imported from China in EU is 6307909899 and the duty rate is 6.3%. You can see below for more information:

Korea:

The duty paragraph for face masks imported from China in Korea is 6307909000, and normally, the tariff is 10%. However, from March 18, 2020 to June 30, 2020, Korea has been suspending imposing tariff for face masks from China(0 tariff currently), see below for more information:

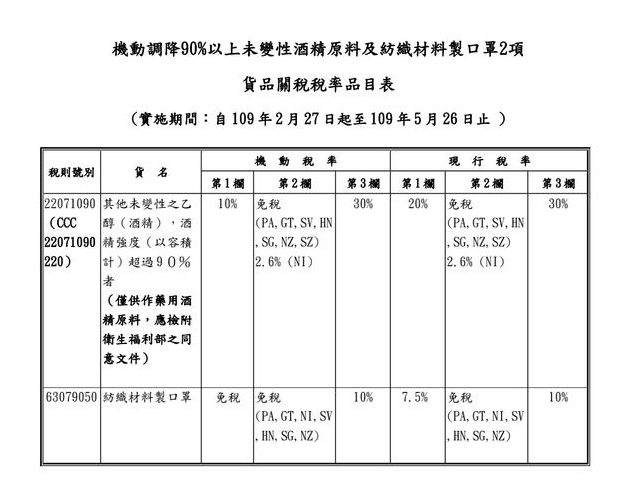

Taiwan, China:

The HS code(also referred to as duty paragraph) of face masks imported from China mainland in Taiwan is 63079050.

And, the duty rate for face masks imported from China mainland is 7.5%. However, from February 27, 2020 to May 26, 2020, provisional tax rates (also referred to as“flexible tax rateâ€in Taiwan area) for face masks was carried out in Taiwan area, i.e. the tariff is zero. You can see below for more information:

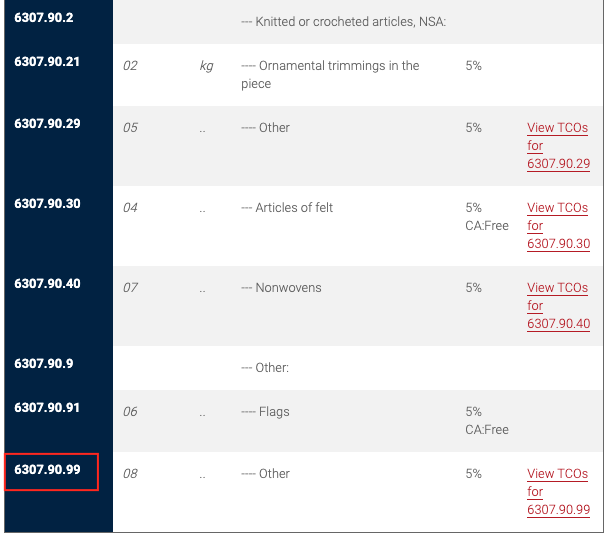

Australia:

The HS code of face masks imported from China in Australia is 63079099 and the duty rate is 5%. See below for more information:

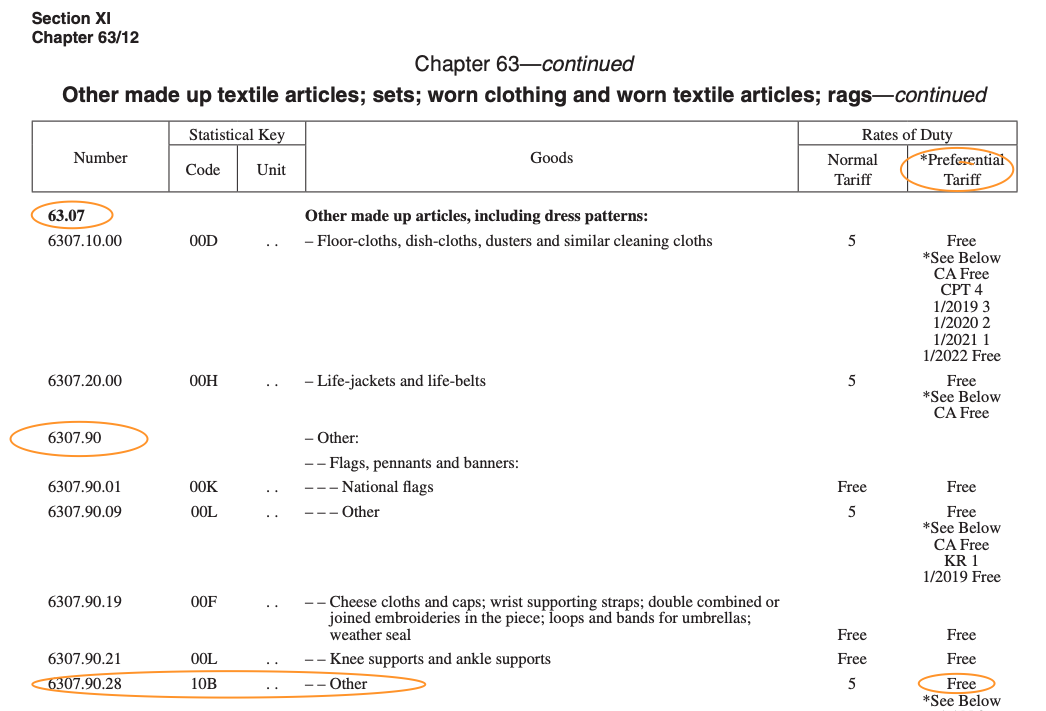

New Zealand:

The HS code of face masks imported from China in New Zealand is 63079028. Zero tariff is applied to the face masks imported from China according to “New free trade agreementâ€. See below for more information:

To learn more, see below document:

face-mask-hs-code-and-tariff-in-some-countries

Hope the above information is useful to you. And if you have any queries, comments or suggestions, contact us anytime. We will be glad to help you.