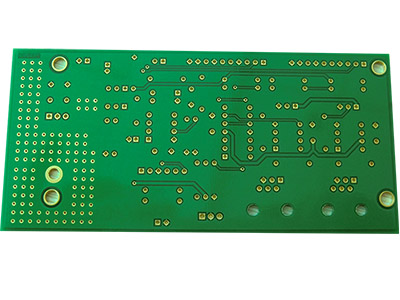

The customs code for printed circuit boards is 8534-0000. 8534 is the classification code for this item, and 0000 represents the sub-classification code under this item. In the actual customs declaration process, it is necessary to select the corresponding sub-classification code according to the specific classification standard of printed circuit boards.

hs code printed circuit board:85340000

PCBs made of FR-4 material (i.e. silicon tetrachloride fiberglass board) are classified under HS code 8534.00.00

hs code printed circuits with more than six layers:85340010

hs code printed circuits with four layers or less:85340090

The HS code for PCB (printed circuit board) is 8534001000.

HS code of PCBA is 8543709990

How do you classify printed circuit boards?

According to different classification standards, printed circuit boards can be divided into many types, such as single-sided boards, double-sided boards, multi-layer boards, rigid boards, flexible boards, etc.

The role of HS codes for printed circuit boards

HS codes are a way for customs to classify goods, and are also an important basis for import and export statistics. As an electronic component, printed circuit boards also need to be HS coded so that customs can accurately classify and manage them.

Types of HS codes for printed circuit boards

There are two main HS codes for printed circuit boards: 85340010 and 85340090. Among them, 85340010 is mainly used for printed circuits with more than six layers, while 85340090 is mainly used for printed circuits with four layers or less. The difference between the two codes lies in the number of layers of the printed circuit board, because printed circuits with more than six layers require higher technical requirements and more complex production processes.

How to choose the correct HS code

The specific HS code may vary depending on product specifications, materials and other factors. Therefore, in actual operation, it is recommended to consult relevant departments or professionals according to the specific situation to ensure accuracy. If you are not sure which HS code to choose, you can consult the printed circuit board manufacturer or relevant industry associations for more professional advice.

How do I do a customs declaration?

- Declare the code accurately. Select the sub-classification number corresponding to the printed circuit board according to the actual situation to avoid penalties or detention caused by coding errors.

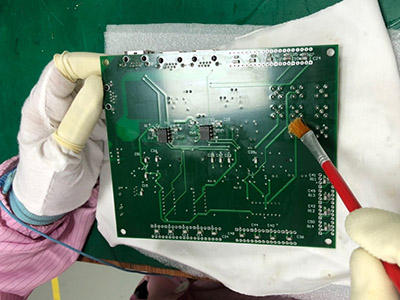

- Provide a complete production process. The production process of the printed circuit board needs to be provided in the customs declaration, including the procurement, production, processing, testing and other links of the materials, so as to facilitate the customs inspection of the printed circuit board.

- Declare accurate materials and technical parameters. The technical parameters such as the substrate, copper foil thickness, board thickness, drilling diameter, line width, line spacing, etc. used in the printed circuit board need to be accurately declared in the customs declaration.

- Re-declaration is required if the dominant production process is changed. If the dominant production process is changed, it is necessary to re-declare to the customs and re-make the customs declaration.

- Comply with relevant national quality standards. Printed circuit boards need to meet relevant national quality standards, such as ISO, UL, etc.

hs code electronic,How do I find an HS code?The HS code for PCB (printed circuit board) is 8534001000. PCBs made of FR-4 material (i.e. silicon tetrachloride fiberglass board) are classified under HS code 8534.00.00